On this date in 1934, redlining emerged as a key component of American public policy. Redlining is the systematic denial of several services by federal government agencies, local governments, and the private sector, either directly or through the selective raising of prices.

Although informal discrimination and segregation existed in the United States, the specific practice known as "redlining" began with the passage of the National Housing Act of 1934, establishing the Federal Housing Administration (FHA). Racial segregation and discrimination against non-white and non-white communities predated this policy. Implementing this federal policy aggravated the decay of non-white inner-city neighborhoods caused by the withholding of mortgage capital. It made it even more difficult for neighborhoods to attract and retain families who could purchase homes. The assumptions in redlining resulted in a significant increase in residential racial segregation and urban decay in the United States.

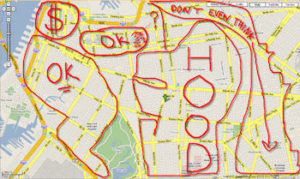

In 1935, the Federal Home Loan Bank Board (FHLBB) requested that the Homeowners’ Loan Corporation (HOLC) examine 239 cities and create "residential security maps" to assess the level of security for real estate investments in each surveyed city. The maps outlined in green are the newest areas considered desirable for lending purposes, known as "Type A." These were typically affluent suburbs on the outskirts of cities. "Type B" neighborhoods, outlined in blue, were considered "Still Desirable," whereas older "Type C" neighborhoods were labeled "Declining" and outlined in yellow. "Type D" neighborhoods were outlined in red and were considered the riskiest for mortgage support. These neighborhoods tended to be the older districts in the center of cities; often, they were also Black neighborhoods.

Urban planning historians theorize that private and public entities used the maps for years afterward to deny loans to people in black communities. However, recent research has indicated that the HOLC did not redline its lending activities and that the racist language reflected the bias of the private sector and experts hired to conduct the appraisals. Private organizations also created redlined maps, such as J. M. Brewer's 1934 map of Philadelphia. Private organizations created maps designed to meet the requirements of the Federal Housing Administration's underwriting manual. The lenders had to consider FHA standards to receive FHA insurance. FHA appraisal manuals instructed banks to avoid areas with "inharmonious racial groups” and recommended that municipalities enact racially restrictive zoning ordinances.

Neighborhoods with a high proportion of non-white residents are more likely to be redlined than neighborhoods with similar household incomes, housing age, and type, and other determinants of risk, but differing racial compositions. While the best-known examples of redlining have involved denying financial services, such as banking or insurance, other services, including healthcare (see also Race and Health) or even supermarkets, have also been denied to residents. In the case of retail businesses, such as supermarkets, purposely locating stores impractically far away from targeted residents results in a redlining effect. Reverse redlining occurs when a lender or insurer particularly targets minority consumers in a non-redlined area, not to deny them loans or insurance, but to charge them more than would be charged to a similarly situated white consumer.

In the 1960s, sociologist John McKnight coined the term "redlining" to describe the discriminatory practice of excluding areas from bank investments based on community demographics. During the heyday of redlining, the areas most frequently discriminated against were Black inner-city neighborhoods. In Atlanta during the 1980s, investigative reporter Bill Dedman wrote a Pulitzer Prize-winning series of articles that revealed banks often lent to lower-income whites but not to middle-income or upper-income African Americans. The use of blacklists is a related mechanism also employed by red liners to track groups, areas, and individuals that the discriminating party believes should be denied business, aid, or other transactions. In the academic literature, redlining falls under the broader category of credit rationing.