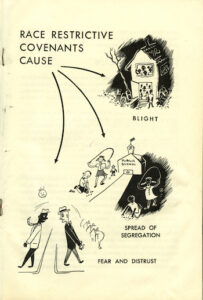

*On this date in 1924, Black History and restrictive housing covenants in America are affirmed. Historically, restrictive covenants were used in real estate transactions to influence the demographics of communities in the U.S. The restrictions kept certain populations out of specific neighborhoods, encouraging racial, ethnic, and cultural segregation.

It wasn't uncommon for real estate contracts to bar Black and Jewish Americans from buying properties. For example, covenants were used in Washington State between the 1920s and 1940s to keep these groups out of some Seattle-area neighborhoods. Black, Jewish, and Asian Americans had to look for housing elsewhere, forming segregated communities. The Goodwin Company attached racially restrictive covenants to property it sold in Washington State from 1924 to 1938. The Goodwin property deeds stated that property could not be sold "to any person not of the White race; nor shall any person not of the White race be permitted to occupy any portion of said lot or lots or of any building thereon, except a domestic servant actually employed by a White occupant of such building."

In 1948, the U.S. Supreme Court ruled that these racial provisions were unconstitutional under the country's equal protection laws after hearing the case of Shelley v. Kraemer. The ruling came after Missouri's top court blocked the Shelleys, a Black family, from living in the home they bought in 1945 in St. Louis. The Kraemer's, a White family who lived nearby, sued to prevent the Shelley's from moving into the neighborhood, citing a restrictive covenant prohibiting people of color from occupying the property.

Mortgage lending discrimination is illegal. Suppose you think you've been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age. In that case, you can file a complaint with the Consumer Financial Protection Bureau or the U.S. Department of Housing and Urban Development (HUD). Despite the ruling, racial deed restrictions remain on the books in nearly every state in the U.S. While the covenants are no longer enforceable, the offensive language still exists.

The Fair Housing Act is a federal law that protects people from discrimination when they rent or buy a home, get a mortgage, seek housing assistance, or partake in other housing-related activities. The Act prohibits discrimination in housing based on race, color, national origin, religion, sex (including gender, gender identity, sexual orientation, and sexual harassment), familial status, and disability. The Fair Housing Act is also known as Title VIII of the Civil Rights Act 1968.6.

If you live in a planned community, the homeowner's association (HOA) and the individual lot owners have the right to enforce covenants. However, violations can become unenforceable through laches—the loss of a right through undue delay or failure to assert it. For example, say you build a fence that violates the restrictive covenants. If the HOA doesn't try to enforce it until several years later, they could lose their rights to enforce through laches—meaning, you get to keep your fence. A restrictive covenant in real estate mandates owners and tenants to avoid or take specific actions to preserve the value and enjoyment of the adjoining land.

For example, restrictive covenants can prevent owners and tenants from making certain renovations, having pets, parking RVs in the driveway, or raising livestock. Covenants that pass from owner to owner are said to "run with the land." Turning your home's equity into flexible cash is an option to consider. Equity is the difference between what you owe on your mortgage and what your home is currently worth. With LendingTree, you'll see competing quotes from a nationwide network of lenders to your best rate. They'll compete to earn your business so you get the most from your equity.